Mortgage Rates Move Ahead of Fed

Alan Fine • May 10, 2022

Mortgage Rates moved ahead of the Fed

On November 3rd, 2021, the Fed announced its change in strategy from a lower interest rate environment to higher interest rates. Mortgage(conforming) rate 30-year loans were offered at 3.25%. Since then, the 30-year mortgage rate has reached 5.50% (National Average).

After the mortgage rates moved up by 2.25%, the Fed increased the Fed Funds rates by 0.5% on May 4th, 2022. The Mortgage and Treasury Markets did not wait for the Fed to make their move but moved well ahead of the Fed. Rates have been moving up Quickly.

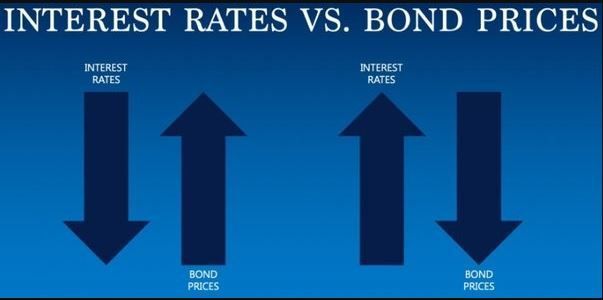

The Fed only directly controls short-term interest rates. The borrowing costs that matter most for consumers are medium and long-term interest rates. These rates are set in global bond markets by traders who are betting on countless factors, including how high and volatile inflation will turn out to be, the strength of growth and investment, and how much debt the U.S. government issues — and in turn how the Fed will react to all of that.

Though the initial market reaction of economic fears to falling global stock prices, fooled investors buying Treasury and easing rates to their recent lows occurring before the Fed Rate Cut. This is where the technical indicators show their value they indicated bottoming of rates. Since the Fed Cut, the Mortgage & Treasury Rates (Yields) shot significantly higher.

This discusses the upward movements that occurred in the Bond & Mortgage rates prompted by rising inflation seen by the sharp increase in the Consumer Price Index that well exceeded the Fed’s target inflation rate of 2.0%. It is a myth the Fed has ultimate control of consumer & investors interest rates.